Not a Member? Join us today!

It's easy to join! Apply for your lifetime Membership with iTHINK Financial in about 10 minutes.

MEET WITH US ON YOUR TIME

Schedule an in-branch or phone appointment at a time convenient for you.

Featured Products

You can turn to iTHINK Financial for the right solutions to all of your financial needs!

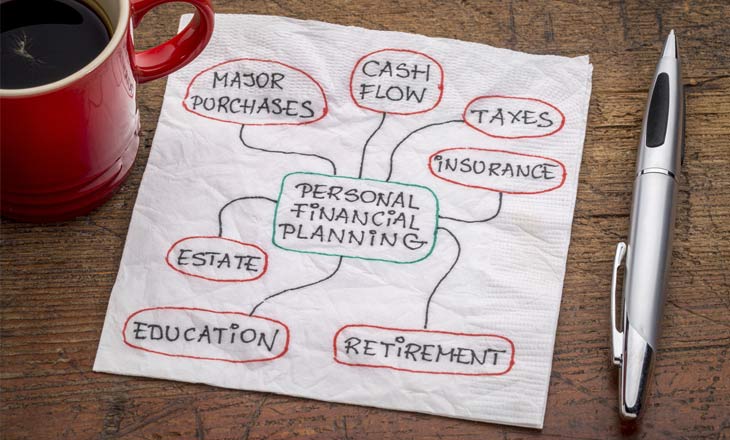

Financial Planning: A Step-by-Step Guide on Building Your Future

By: iTHINK Financial | Oct 06, 2021

So you're a young adult and realize you have no idea how to start saving for your future or even when you should start. The time to start is now. Even if you are in your teens, the earlier, the better.

So, where do you start? There are so many ways to begin to plan for your financial future, some more technical than others. If you are confused about the process, keep reading this article as we dive into financial planning for your future.

Begin With a List

There's truly nothing better than writing down lists for everything you need to do. The same goes for the steps you must take to start saving for the future.

You need to decide on a monthly budget, how much of your savings should go to retirement, your income streams, insurance coverage, investments, and all the bills you need to pay monthly.

Don't forget the grocery bills, your income streams from selling some of your clothes, or your taxes. Once you have the list, it's time to tackle planning for the future.

Set a Monthly Budget

The first thing we'll dive into for your planning purposes is creating a monthly budget. If you don't manage how much you spend, your savings will go out the window.

To do this, write down all your expenses. This first step includes your pet's food, iced coffees, and any other luxuries. Do not leave anything out. The minor payments are still essential to determine your budget.

Next to each category, jot down the maximum amount you want to spend. This part gives you a good idea of how much you can spend on each item, like how many times you go out to eat or how many concerts you can afford to go to each month.

Every month, you need to sit down and fill out each category with the amount you spent. This step will give you an idea of where you can tweak things and start saving more.

Plan to Save and Invest

Each part of your monthly income and monthly budget should include money to set aside to save or invest.

It would help if you had a set percentage or amount of money you want to save per month. Even if this is just $50 per month, at least you are saving! And as you get older and progress in your career, this number will most likely go up without thinking much about it.

You also want to start thinking about setting money aside for more significant investments where your money will begin to grow. But first, you need to understand investments.

At first, it would be best if you decide between investing in real estate, the stock market, mutual funds, bonds, or something else. Taking time to learn about the different types of investments will pay off in the end.

Set Your Financial Goals

It can be hard to determine what you need to save or how much you can spend if you don't set financial goals. Goals come in all types and sizes, from retirement to savings accounts or getting your dream home. Write them down and get ready to work toward each of them!

From there, you can then chunk these down into smaller goals to make sure they are achievable. This way, you'll have a step-by-step guide that you've created yourself to prevent you from getting overwhelmed by everything you want to do financially.

The best way to set financial goals is to set S.M.A.R.T goals for yourself.

Pay Off Your Debt

Once you set your financial goals, you must start setting out to achieve them. One way to do so is to work toward paying off your debt. If you don't have any debt, that's great! You can skip this step. But if you do, keep reading.

The best way to stay disciplined with paying off your debt is by sticking to your already created monthly budget. The earlier steps in our budget plan set aside money for savings, which you can use to mitigate your debt responsibilities. On top of that, you can add your debt payments onto the list to already have to pay them off, factored into what you spend each month.

There are two ways to pay off debt. You can prioritize your smallest debts first and pay those off, or you can decide to pay the minimum on every loan you have. There are pros and cons to both.

Prepare for Retirement

If you work in the corporate world or an employer, you probably already have this set up automatically. And if you do, it's still worth it to check what's going in there and how it works. If you work for yourself, you will have to prepare for retirement on your own.

Working for an employer will most likely set you up with a 401K or possibly a 403B if you are a teacher. If you work for yourself, you can open your own IRA or Roth IRA.

The difference between the two is how taxes work. An IRA will not be taxed until the money is withdrawn from the account, while the Roth IRA will tax the money being put into the account now.

Get Insurance Coverage

Often overlooked, this step helps when it comes to planning for the future. Although we always hope and pray that it doesn't happen to us, it's always beneficial to prepare for the worst when saving for the future.

Getting insurance will cover you and your assets if something does, unfortunately, happen to you in the future. There are multiple types of insurance you should consider.

Life Insurance

Life insurance is a must! This type of insurance will insure your life, basically giving your beneficiaries the money you are worth once you pass away. This part is vital in case you die unexpectedly or suddenly.

Homeowner's Insurance

If you are a homeowner, having insurance that will cover your home itself and all of its contents is vital. This type of insurance will cover any damage from storms or natural disasters, damage from trees or wind, and theft from crime.

Health Insurance

It may be frustrating to pay money monthly when you don't visit the doctor often. However, if something happened and you ended up in the hospital, all those payments are worth it.

Instead of paying $16,000 out of pocket for emergency services, you could pay $200. This example depends on your insurance but illustrates how not having health insurance can prove disastrous to your financial planning.

Auto Insurance

Auto insurance is much like homeowner's insurance. If you are a car owner, it's important to insure your vehicle in the event you get in an accident, whether it is your fault or someone else's fault.

Update Your Financial Plans Regularly

It can be easy to set a financial goal and a budget and stick to it for months at a time. But if you have a life event like getting promoted or having a child, you will most likely need to adjust your budget to match your lifestyle.

If you are young, you may only be saving a small amount of your paycheck and using the rest to go out on the weekends with your friends. It can be easier to navigate how much you spend with friends on a night out while putting more into savings and investments if your paycheck increases.

If you have a child or are sending a child to college, you will have to add those plans to reflect that on the budget sheet. Let's face it. Kids aren't cheap!

Get Help with Your Financial Planning

One of the best things you can do for yourself when it comes to saving for your future is not to be afraid to ask for help. If you are stuck or unsure where to start, you should always ask, or you won't get anywhere! Looking into reviews and testimonials at different financial centers will help you decide which center is right for you. You can also look more into it by consulting with the center to see how they can help you!

Many financial centers offer help with budgeting, financial goals, savings and retirement, and even different types of investment planning.

Start Financial Planning Today

If you're ready to start financial planning today, don't wait! Contact us to help you get started with everything you need to do to meet your financial goals.

You'll look back and think of how happy you are now that you took the leap and got started.

Upcoming Events

Check out the upcoming events happening at iTHINK Financial.

Quick Pay and Skip-A-Pay

Make a loan payment or skip your upcoming loan payment without logging in to Online Banking!